Thousands of families in Montgomery County are not required to file Federal or Maryland Income Tax returns because they do not meet the minimum income level. But they may be missing out on thousands of dollars in tax refunds which they are eligible to receive.

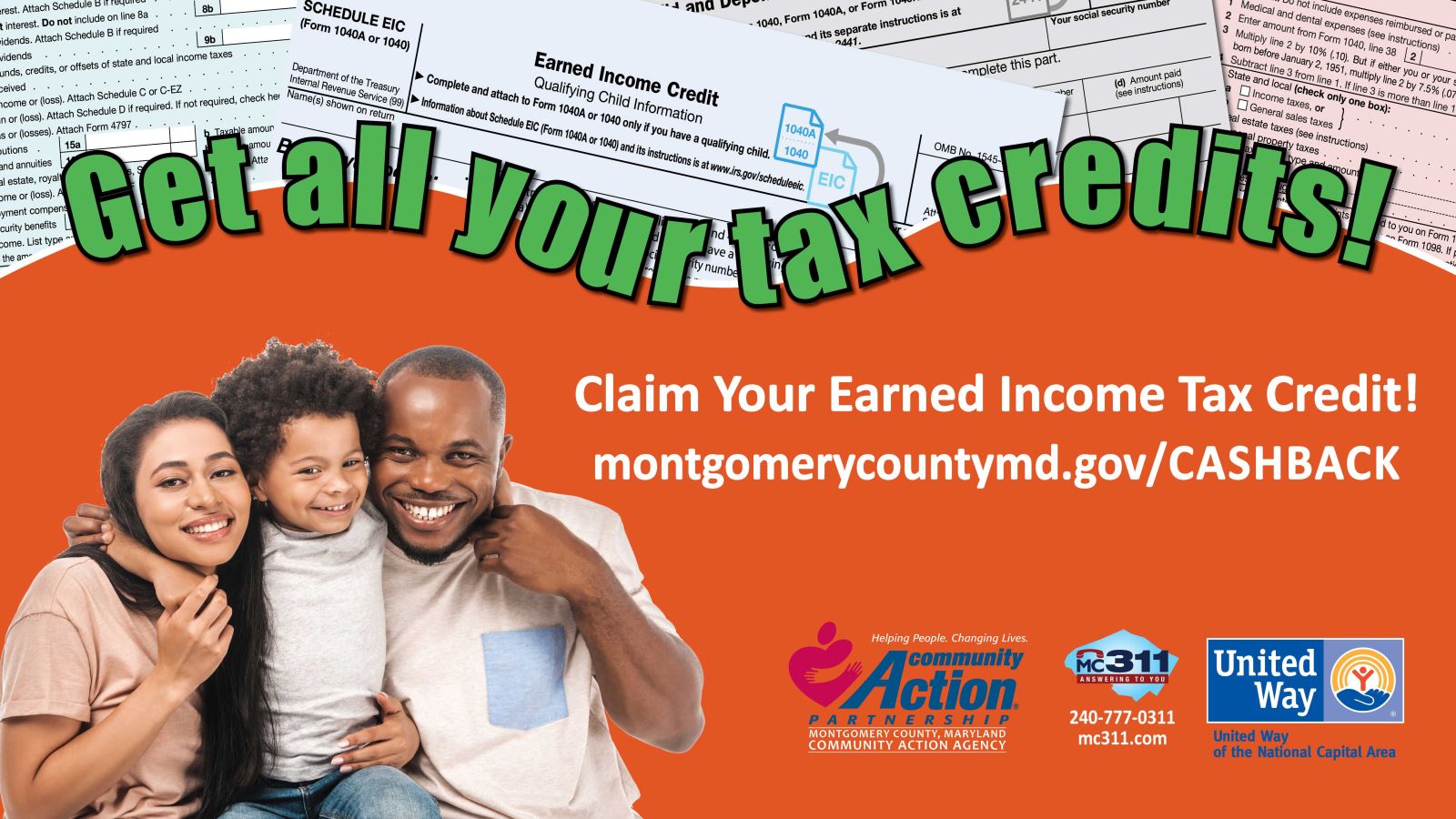

Maryland’s Earned Income Tax Credit (EITC) has been expanded and most people who receive it also get back money from Montgomery County’s Working Families Income Supplement, even if they file with an Individual Taxpayer Identification Number (ITIN) or are single or senior.

In Montgomery County, Community Action’s Volunteer Income Tax Assistance (VITA) program offers free income tax preparation to Montgomery County households making up to $60,000 annually. IRS-certified preparers have been available since January 23, 2023, to help residents find their refund. Appointments available at sites in Gaithersburg, Rockville, Silver Spring and Wheaton.

Get more information at montgomerycountymd.gov/cashback or by calling 240-777-1123. Arrange for an appointment through Montgomery County Community Action Agency Rockville, MD 20852 (appointment-plus.com)

Tax Aide is available at the Poolesville Maggie Nightingale Library on Fridays until 4/18.

Appointments are required for consultations from 10:15 a.m. to 2:30 p.m. You can request an appointment by phone at (240)777-2577 or online 24/7 at Schedule Appointment with Tax-Aide (as.me)